There are only three possible scenarios in Forex. You either buy (it is also called to open a long position) or sell (open a short position). Or you do nothing, waiting for the right moment.

Based on this, one trader buys and another one sells at the same time. And that is why the competition begins as well as all these leaping price movements. This competition is also called competition between the bulls and bears.

A bear is a trader selling for a fall. A bull is one who buys for a rise. And so is the life of these two irreconcilable forces in the Forex market.

Let's go back to our origins and think of the most important rule of any market. To buy cheap and to sell expensive.

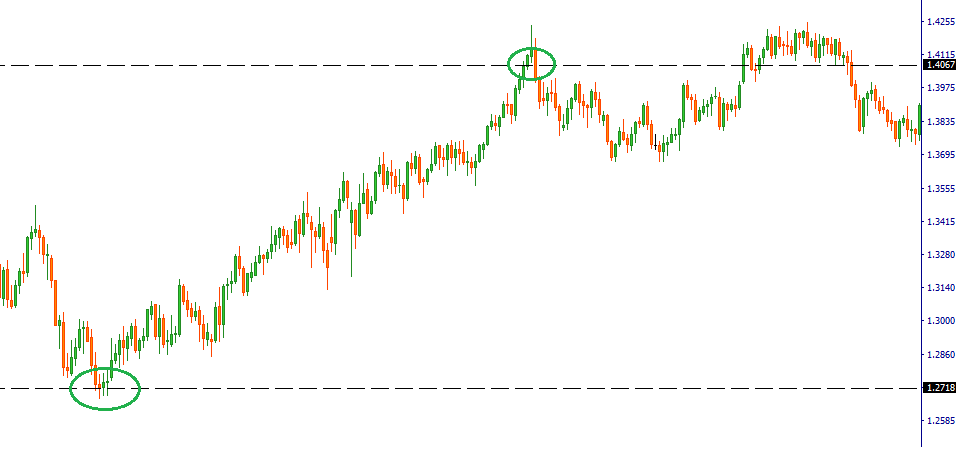

For example, we had a pound-dollar chart. We decided to buy at 1.2715.

The price fell slightly and then began to move in the direction we needed. You decided to close the transaction. At that time, the price was fixed at 1.4065. We would earn 1350 points in total.

Income in points is a very abstract notion, so let's see clearly how much we would earn in US dollars. Our income depends on a certain basket of factors, including the amount of the deposit.

Let’s consider the case where you are trading your own funds. You have 1,000 dollars on your account and you have just closed the transaction at a profit of 1350 points.

Your profit makes 13.5%, and you will obtain 135 dollars of income. If you had 5,000 (five thousand), your income would make 675 dollars. Well, and if your deposit made 10,000 (ten thousand), you would earn even 1350 US dollars.

Of course, you cannot always make a profit. There are costs in the market. So, your costs would make 10 dollars if your deposit were 1,000 dollars. And they would make 50 dollars if your deposit were 5,000. If the deposit were ten thousand, the costs would make one hundred dollars. Your income is much higher than the costs, and this is both pleasant and correct.

Of course, everything depends on what lot you start the transaction with. For example, during the calculation of income when you trade your own funds, we used 0.01 lot for the transaction opening.

So, you have already decided what lot you will trade with. You decide whether to buy or to sell the chosen asset, i.e. the transaction direction. Later on, you need to place an order for a specific type of transaction, i.e. the purchase order or sales order.

The order is a directive given to the broker to operate the transaction with a certain amount and exchange rate.

There are immediate execution orders and pending orders.

Immediate execution orders are those for the purchase or sale of the asset at the current time according to the current market price.

Pending orders are the bids the for purchase or sales of the asset at a desired price. A specific feature of those orders is that it is not necessarily that the price will reach this point. However, you will not miss a profitable transaction for sure, if you have no access to the computer.

Оцените изложенный материал