Leverage is the use of borrowed money to invest in a currency, stock, or security. The concept of leverage is very common in forex trading. By borrowing money from a broker, investors can trade larger positions in a currency.

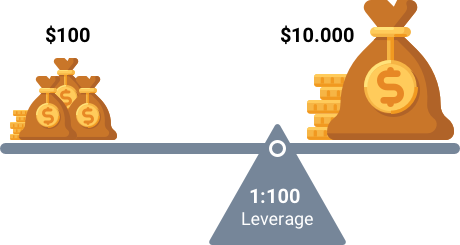

What does 1:100 leverage mean?

It means that the broker allocates funds for you that are 100 times higher than yours. In other words, you can open transactions that are 100 times higher.

Let's study leverage trading by using our transaction as an example from the article "Opening a position". Let’s take, for example, 1 to 10 leverage.

The situation is the same. We have three types of deposits: 1000, 5000, and 10 000 USD.

With a 1000 USD deposit and 1/10 leverage, we would earn 1,350 dollars, which is ten times more than if we were trading without the leverage. With a 5000 USD deposit, our income would make 6,750 dollars. With a 10 000 USD deposit, our income would be increased to 13,500.

When we were trading without leverage, our profit made 13.5%. And now, when the leverage is one to ten, it increased ten times, i.e. up to 135%.

However, we should remember that there are two sides to the same coin. If the profit increases, the costs will increase proportionally. When the deposit is 1,000 dollars, the costs will make 100 dollars. If the deposit is 5000, the costs will make 500. If the deposit is 10 000, our costs will increase to 1000 USD.

Оцените изложенный материал