The spread is the difference between the buy price and the selling price. It is like at currency exchange offices or banks. It is always more expensive to buy the currency than to sell it.

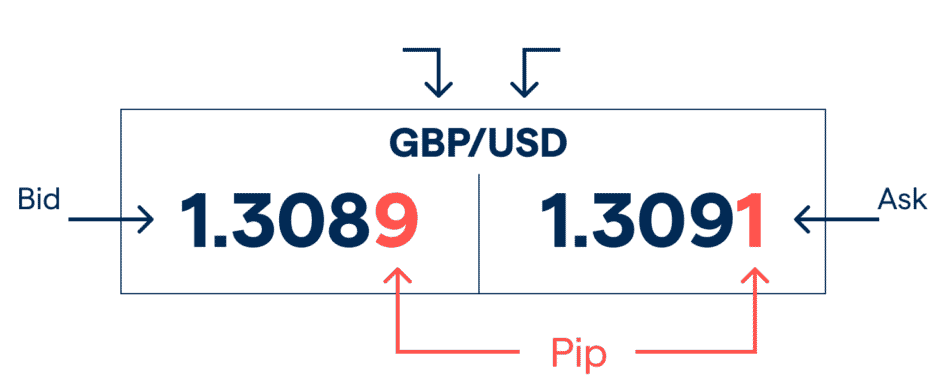

Consider the following example. GBP/USD pair. There are two prices. BID and ASK price. The BID price is 1.3089. The ASK price is 1.3091

Any PURCHASE operation is carried out at the ASK price.

Any SALES operation is carried out at the BID price.

SPREAD is a difference between ASK and BID. And in the case of the GBP/USD, it makes two points (pips).

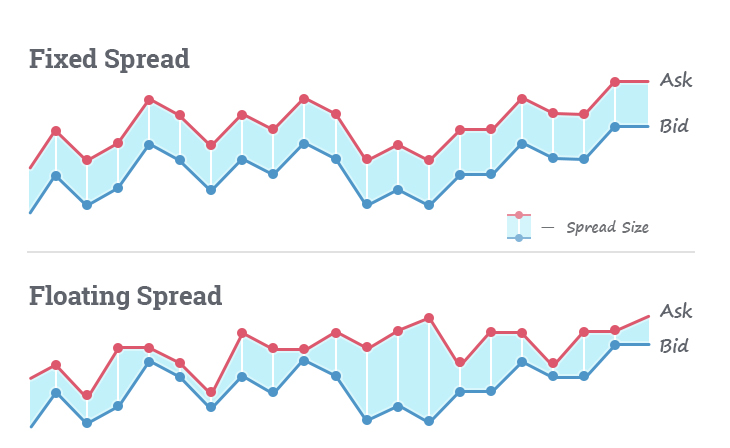

Floating and fixed spreads

For some financial instruments, such as exotics, as well as in certain situations, for example, in moments of important news, the broker may set a wider or floating spread. Visually, this looks like what you see in the picture. With a fixed spread, the distance between the Bid and Ask price is always the same, for example, 2 points. With a floating spread, the distance between the Bid and Ask price is always changing, it might be 2 points or even 10

Оцените изложенный материал